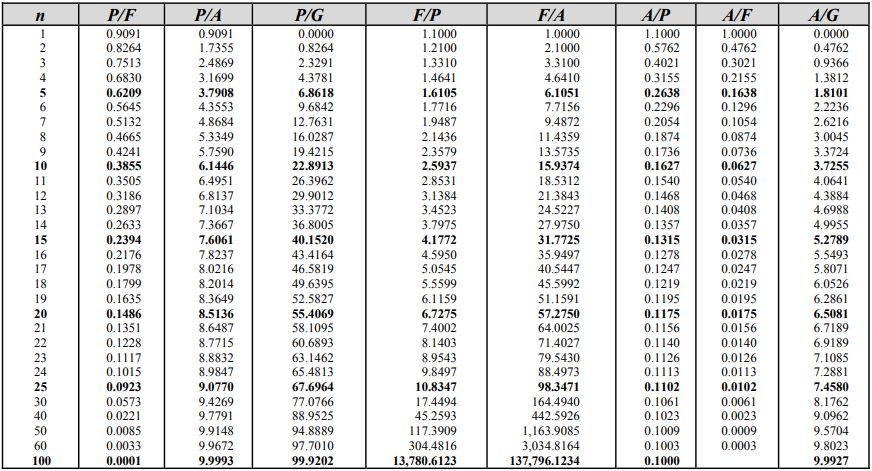

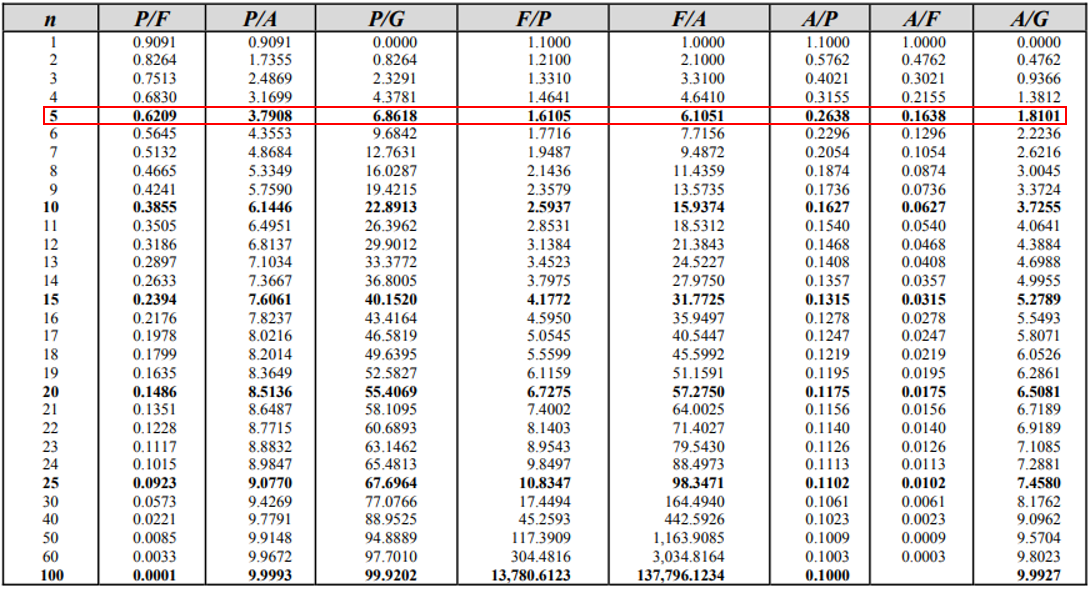

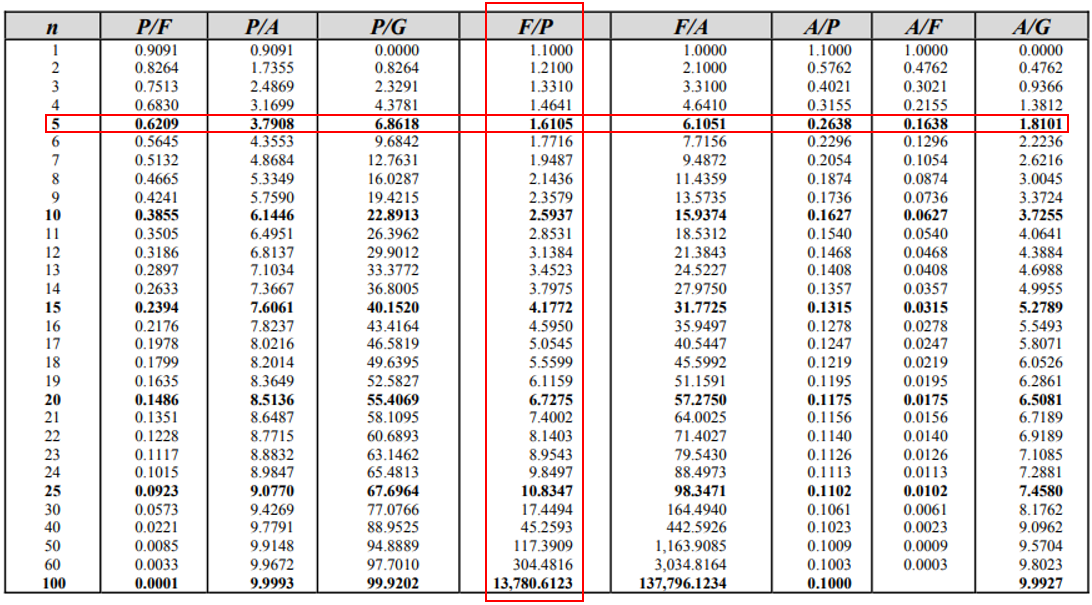

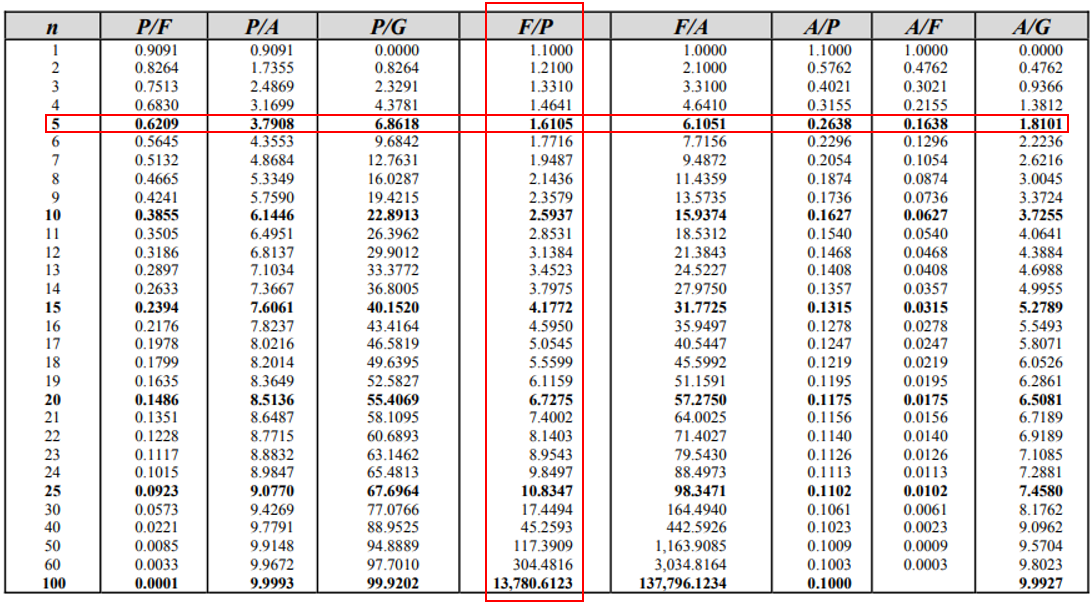

Interest Rate Table

Using the interest rate table below, how much money would have accrued after 5 years if $2,000 is invested now at 10% compounded annually?

Expand Hint

The problem statement is asking for growth after 5 years, so

$$n=5$$

:

Hint 2

We are trying to solve for the Future,

$$F$$

, given the present value,

$$P$$

, of $2,000.

The problem statement is asking for a single payment based on a compounded amount. Based on the givens:

$$n$$

, the number of compounding periods, is 5. We are trying to solve for the Future,

$$F$$

, given the present value,

$$P$$

, which converts to

$$F\:given\:P$$

.

The intersection value, 1.6105, from the 10% Interest Rate Table is the compounding factor. Thus, the initial investment will grow into:

$$$Future=Present \times Factor$$$

$$$Future=\$2,000 \times 1.6105=\$3,221$$$

Note, we can check our answer with the below formula:

$$$(1+i)^n=(1+0.1)^5=(1.1)^5=1.6105$$$

where

$$i$$

is the interest rate, and

$$n$$

is the number of compounding periods. Because our compounding factor matches with the table, we confirmed that our initial answer is correct.

$3,221

Time Analysis

See how quickly you looked at the hint, solution, and answer. This is important for making sure you will finish the FE Exam in time.- Hint: Not clicked

- Solution: Not clicked

- Answer: Not clicked

Similar Problems from FE Sub Section: Single Payment Compound Amount

144. Interest

377. Investment Growth

551. Bond

Similar Problems from FE Section: Nomenclature and Definitions

117. Housing Down Payment

142. Saving for the Future

144. Interest

324. Simple Interest

377. Investment Growth

551. Bond

581. Savings

632. Down Payment

657. Landing Gear